when are property taxes due in chicago illinois

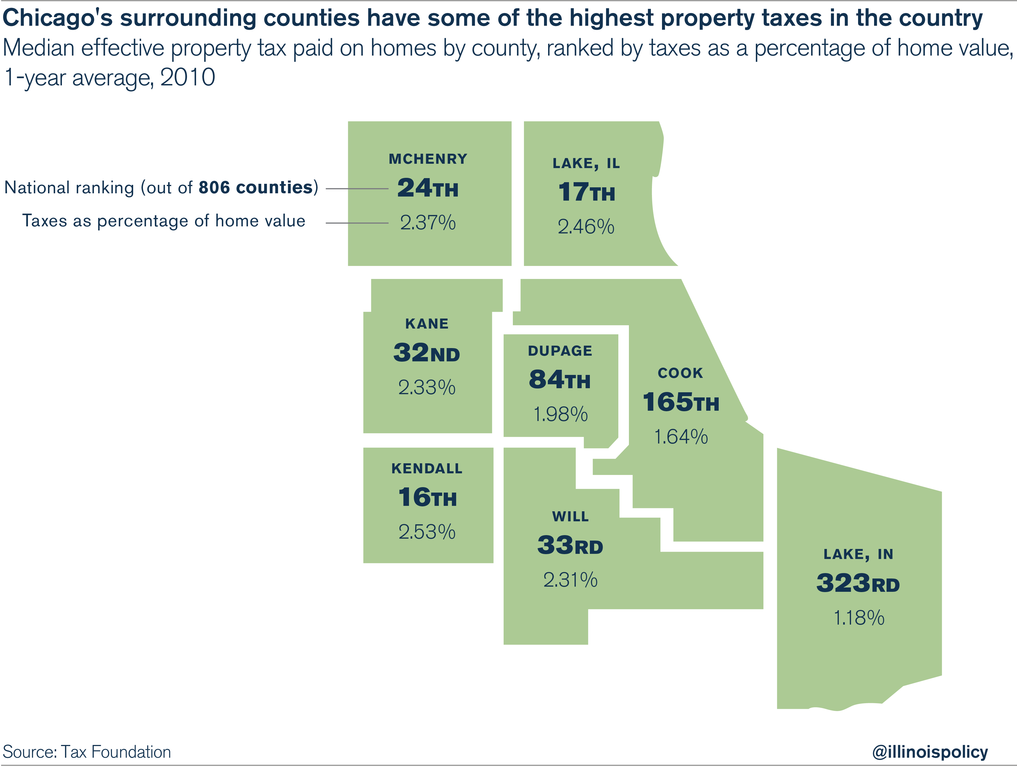

Property tax rates in Cook County are actually lower than the state mark with an average rate of 210 in the county compared to 216 for the state. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the.

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

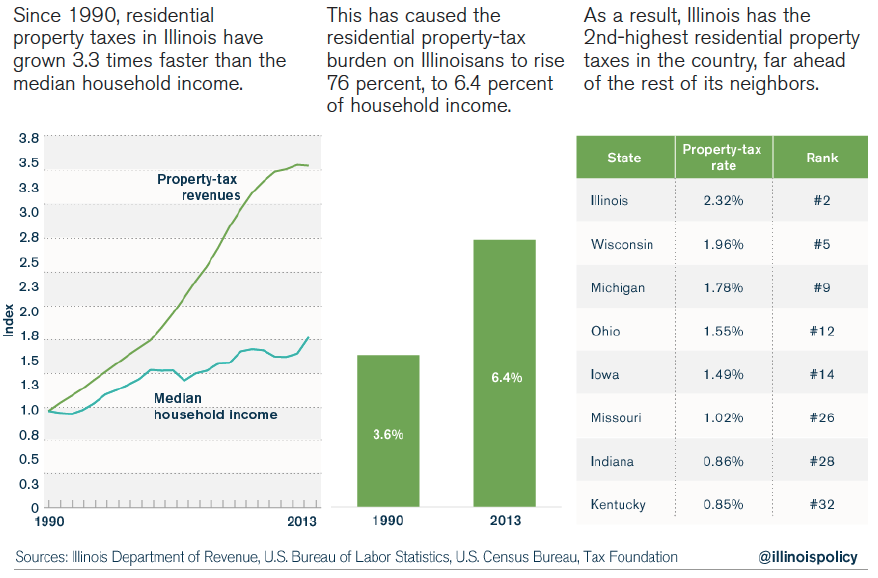

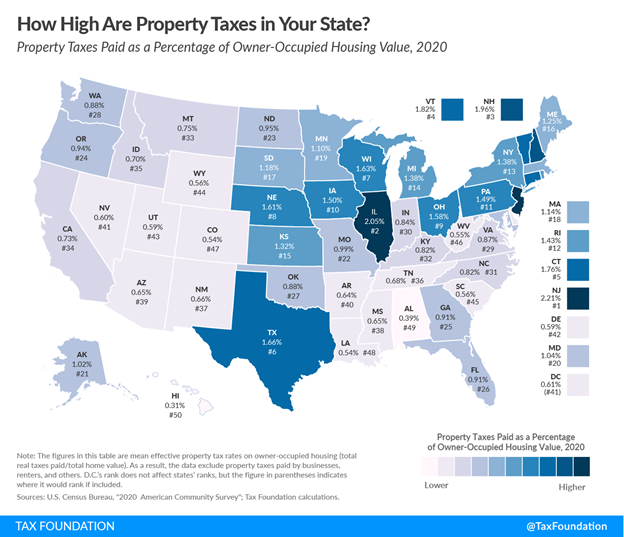

The effective tax rate in the state is 2016 which is nearly twice the national average.

. Late payments will be charged. Odds are growing that the due date on 16 billion in Cook County property tax bills will be Dec. A letter obtained by the ABC 7 I-Team from Cook County Clerk Karen Yarbrough and Treasurer Maria Pappas asked Kaegi Tuesday to sign a document asserting that his office.

The Illinois Department of. Has yet to be determined. Riverside Plaza 1650 Chicago IL 60606 t 3123465700.

Property Tax Consultant. To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly. How Wealthy Investors are Making Millions Exploiting Illinois Property Tax Law Executive Summary.

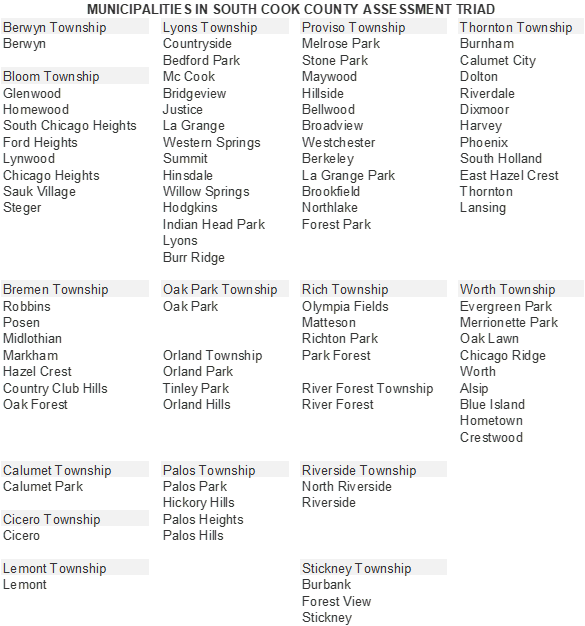

Job in Chicago - Cook County - IL Illinois - USA 60290. Property taxes in the Chicago region. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

Tax Due Dates Extended Due To Covid-19. Cook County Treasurer Maria Pappas and her office have sent out the second property tax bill installment which is due October 1. Tax Year 2021 Second Installment Property Tax Due Date.

The Portal consolidates information and delivers. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly.

Youll likely get your property tax bill this yearbut only barely. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet. The mailing of the bills is dependent on the completion of data by other local and.

For more information about taxes in Chicago you may visit the Tax Division of the. A new law that seemed like a simple fix has sparked an outcry for a do-over. Restaurant Tax guidance for.

Chicago Office Illinois Policy 300 S. Lucrative loophole benefits those who purchase delinquent property taxes in Cook County at expense of government new study says. The next round of.

September 9 2021. How Wealthy Investors are Making. Accorded by Illinois law the government of Chicago public.

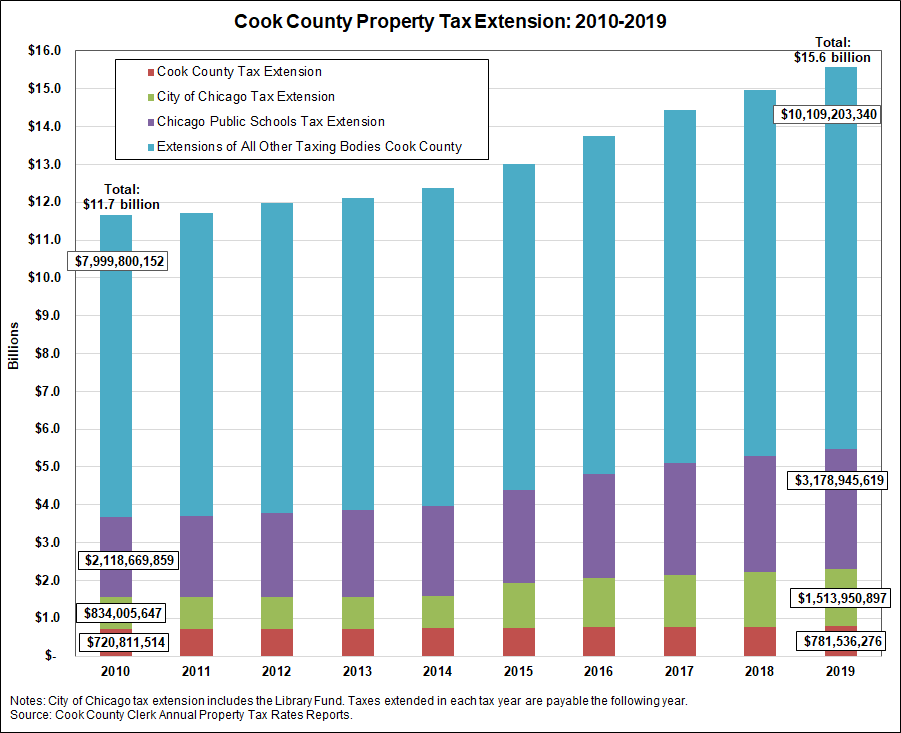

An extra 939 million in property taxes will be collected this year to support the city of Chicago. In Illinois a homeowner must pay 4527 in property taxes every year. Tax Extension and Rates The Clerks Tax Extension Unit is responsible for calculating property tax rates for all local taxing.

There are three basic phases in taxing real estate ie setting levy rates estimating property values and receiving payments. While Cook Countys assessment level of. You were an Illinois resident in 2021 and your adjusted gross income on your 2021 Form IL-1040 is under 400000 if filing jointly or under 200000 if youre filing as a single.

173 of home value. Tax amount varies by county. Cook County sends property tax bills by Thanksgiving due after Christmas.

Explore the Map and Data. Thats what is happening with an amendment to Section 19 of the Illinois Condominium Property. March 2 is when the first property tax payment is due in Cook County.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. Property Tax 101 An overview of the Illinois Property Tax system.

Cook County S Property Tax The Civic Federation

Investors Exploiting Illinois Property Tax Law At Expense Of Black Latino Communities Study Chicago News Wttw

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Madison St Clair Record

Property Tax Burden In The Chicago Region Cmap

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Chicago Squeeze Property Taxes Fees And Over 30 Individual Taxes Crush City Residents

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

How To Pay Less Property Tax In Chicago West Town Real Estate Ask Nagel

By The Numbers Illinois Posts 2nd Highest Property Tax Rate In New National Study Illinois Thecentersquare Com

Cook County And Property Taxes City Of Chicago Appeal Tax

Cook County Senior Citizen Property Tax Deferral Alderman Tom Tunney 44th Ward Chicago

Lightfoot S Budget Passes 1st Test As Plan To Raise Property Taxes Borrow 660m Advances Chicago News Wttw

Tone Deaf Proposal Increase Illinois Property Taxes To Pay Pension Debt Illinois Opportunity Project

New Report Illinois Property Taxes Among Highest In Nation The Civic Federation

Pappas Auction Of Delinquent Cook County Property Taxes Postponed Indefinitely Alderman Tom Tunney 44th Ward Chicago

1235 1237 N Ashland Ave Chicago Il 60622 Loopnet

Cook County Il Property Tax Calculator Smartasset

Everything You Need To Know About Property Taxes In Illinois